If you’re seeing unexplained withdrawals or suspicious fees at a Fort Lauderdale nursing home, the Law Offices of Anidjar and Levine can help you work with a billing fraud lawyer to stop further losses and demand answers fast.

You can request full itemized ledgers, admission agreements, and account histories, then compare charges to the care plan and posted rates to spot duplicates, hidden add-ons, or “level of care” upgrades you didn’t approve.

You can also learn how to dispute charges in writing and escalate complaints effectively.

To further protect your loved one’s rights and safety, consider speaking with a Fort Lauderdale Nursing Home Abuse and Neglect Lawyer.

Key Takeaways

- Investigate suspicious fees, duplicate charges, and unexplained withdrawals tied to Fort Lauderdale nursing home billing.

- Demand itemized statements, full account ledgers, and written explanations; preserve contracts, invoices, care logs, and bank records.

- Compare bills to admission agreements, care plans, and rate sheets to identify unauthorized add-ons or “level of care” upgrades.

- Stop further losses by disputing charges in writing, setting bank alerts, limiting resident-fund access, and requiring dual approvals.

- Escalate through AHCA and the Long-Term Care Ombudsman; involve a billing fraud lawyer to send preservation letters and pursue refunds.

How We Can Help With Your Fort Lauderdale Nursing Home Unauthorized Charges / Billing Fraud Claim

If you’ve noticed suspicious fees or unexplained withdrawals tied to a Fort Lauderdale nursing home, we can step in quickly to investigate what happened and protect your loved one’s finances. You shouldn’t have to fight alone while you’re trying to care for someone who depends on you.

We act fast to preserve records, request account histories, and stop further losses.

You’ll get focused Resident Advocacy from a team that treats your loved one with dignity. We review admission agreements, itemized statements, and payment authorizations, then run targeted Billing Audits to flag irregular charges and missing credits.

We communicate with the facility and insurers on your behalf, demand corrections, and push for prompt reimbursement when money was taken improperly. If the situation involves broader misconduct, you’ll have counsel ready to escalate through formal complaints or legal action.

Throughout the process, you stay informed, your questions get answered, and your loved one’s financial safety comes first.

Understanding Fort Lauderdale Nursing Home Unauthorized Charges / Billing Fraud Cases

Although billing problems can appear to be simple mistakes, Fort Lauderdale nursing home unauthorized charges and billing fraud often follow recognizable patterns that can drain a resident’s funds quickly. You may see repeated fees for services never provided, unexplained “level of care” upgrades, or charges that conflict with the admission agreement and care plan.

To understand your case, you’ll compare statements, contracts, and medical records to confirm what the facility promised versus what it billed. You’ll document dates, conversations, and who approved changes, then preserve invoices, EOBs, and payment receipts.

Consistent billing audits can reveal irregular timing, duplicate line items, and inflated rates that don’t match posted pricing or Medicaid/Medicare rules.

You also protect the resident’s dignity by practicing resident advocacy: asking for itemized bills, requesting corrections in writing, and escalating concerns through proper channels. With organized proof, you can seek reimbursement and stop further losses promptly.

Common Causes of Fort Lauderdale Nursing Home Unauthorized Charges / Billing Frauds

You can face unauthorized nursing home charges when the facility bills you twice, pads invoices, or lists services that never happened.

You might also see unapproved add-on fees slipped into monthly statements without clear consent.

In some cases, staff misuse resident funds, so you’ll want to track every payment, receipt, and account transaction closely.

Duplicate Or Inflated Charges

When you serve a loved one by reviewing statements, compare each entry to the care plan, medication administration records, and staffing notes.

Ask for an itemized ledger, dispute mismatched codes, and request written explanations for every increase.

If patterns repeat, you can document them and seek help fast.

Services Never Provided

Charges for services never provided can sneak into a nursing home bill and look routine at first glance.

You might see therapy sessions, wound care, lab work, or transportation listed on days your loved one was resting, offsite, or never scheduled.

When staffing is stretched, documentation can drift from reality, and billing systems may auto-generate entries without real delivery.

To protect a resident you’re serving, you can request care notes, appointment logs, and medication administration records, and compare them to the invoice.

Ask pointed questions: who performed the service, when, and where?

Consistent service verification helps you separate true care from paper care.

If the facility resists transparency, a lawyer can push for records and coordinate billing audits to uncover patterns and recover improper payments.

Unapproved Add-On Fees

Unapproved add-on fees can slip into a Fort Lauderdale nursing home bill, inflating the balance with “extras” no one agreed to.

You might see charges for premium linens, supplies, transportation, or “administrative” tasks that should’ve been disclosed upfront and authorized in writing.

Watch for Hidden surcharges buried in small print or added after a care-plan change.

You can protect your loved one by comparing invoices to the admission contract, care plan, and rate sheet, then requesting itemized explanations for each add-on.

If the facility can’t show clear consent, you may face Consent disputes where staff claim verbal approval or “standard practice.”

Ask for dates, signatures, and supporting records, and keep your communication respectful but firm.

When you serve families, you help stop improper billing and restore trust.

Misuse Of Resident Funds

Add-on fees aren’t the only way a Fort Lauderdale nursing home bill can balloon—sometimes the problem comes straight from your loved one’s own money. When staff controls a resident trust account, debit card, or checkbook, funds can be skimmed through “cash withdrawals,” unexplained purchases, or payments to vendors you never approved.

You may also see commingling, late fees caused by mishandled deposits, or “borrowed” funds that never return.

You can protect your loved one by demanding monthly accountings, matching receipts to care-plan needs, and setting clear spending limits that support family budgeting. Ask who’s signature authority, require dual approvals for withdrawals, and keep bank alerts turned on.

These steps strengthen asset protection while you keep your focus on compassionate care and accountability.

Legal Rights of Fort Lauderdale Nursing Home Unauthorized Charges / Billing Fraud Victims

Even if you signed a stack of admission paperwork, you still have enforceable legal rights when a Fort Lauderdale nursing home bills you for services you didn’t authorize. Florida and federal rules protect your patient rights, including clear disclosure of charges, accurate statements, and freedom from deceptive practices.

You can demand transparency without fear of retaliation, because your care must remain safe and respectful.

Here’s what you’re entitled to assert when charges look wrong:

- Itemized billing and records access so you can compare claimed services to your actual care plan.

- Corrections, refunds, and dispute resolution when the facility can’t justify a charge or when billing is duplicated.

- Independent review and billing audits that uncover patterns like phantom services, inflated rates, or improper add-ons.

You can also seek compensation if billing fraud causes financial harm, stress, or interrupted benefits. Protecting your family member helps protect the whole community.

Steps to Take After a Fort Lauderdale Nursing Home Unauthorized Charges / Billing Fraud

After you spot unauthorized charges from a Fort Lauderdale nursing home, gather every billing record, statement, and receipt you can. Report the suspected fraud right away to the facility and the appropriate authorities to create a clear paper trail.

Then consult a Fort Lauderdale nursing home billing fraud lawyer to protect your rights and pursue recovery.

Gather Billing Records

Start by pulling collectively every billing record tied to your loved one’s care, including monthly statements, itemized invoices, admission paperwork, and any notices of rate changes or “extra” fees.

Create a single folder (paper and digital) and label items by date so you can quickly track patterns.

Request the resident ledger, care-plan summaries, and copies of authorizations for supplies, therapy, transportation, and pharmacy charges.

Compare charges to the contract terms and the services your loved one actually received, and note any duplicate line items, unexplained “administrative” fees, or sudden price jumps.

For billing audits, highlight questionable entries and record who provided each document.

Practice records preservation: keep originals, scan everything, and save emails, voicemail logs, and envelopes showing postmarks.

This organization protects your loved one and supports fair care.

Report Suspected Fraud

Once you’ve flagged questionable charges, report the suspected fraud right away so the billing trail doesn’t go cold. Call the facility’s billing office and administrator, ask for a written explanation, and request they preserve all invoices, care logs, and payment postings.

If the answers don’t match the records, file a complaint with Florida’s Agency for Health Care Administration and the Long-Term Care Ombudsman Program. You can also contact Medicare, Medicaid, or your insurer’s fraud unit to stop improper reimbursements and protect other residents.

Keep a dated timeline of who you spoke with, what they said, and what documents you sent. If you’re a staff member, document concerns carefully and learn about whistleblower protections.

Pair reporting with community outreach to keep families informed and vigilant together.

Consult Nursing Home Lawyer

Bring in a Fort Lauderdale nursing home billing fraud lawyer early so you don’t get boxed out by missing records, shifting explanations, or looming appeal deadlines. You’ll protect your loved one’s care while you challenge improper charges.

Your attorney can demand itemized statements, admission contracts, and care logs, then compare them to what Medicare, Medicaid, or long-term care insurance should cover through benefit coordination.

You can also ask counsel to lead family meetings with the facility, set clear agendas, and document every promise in writing. If the home blames “billing errors,” your lawyer can trace patterns, identify duplicate or phantom services, and preserve evidence.

You’ll get guidance on reporting options, refund requests, and whether a civil claim is appropriate. Acting quickly helps you serve your loved one and other residents, too.

How a Fort Lauderdale Nursing Home Unauthorized Charges / Billing Fraud Lawyer Can Help You

Although spotting suspicious fees on a nursing home statement can feel overwhelming, a Fort Lauderdale nursing home unauthorized charges/billing fraud lawyer can step in quickly to protect your rights and your finances. You don’t have to confront a facility alone or wonder which charges are legitimate; your lawyer organizes the facts, communicates firmly, and keeps the focus on dignity and fair treatment.

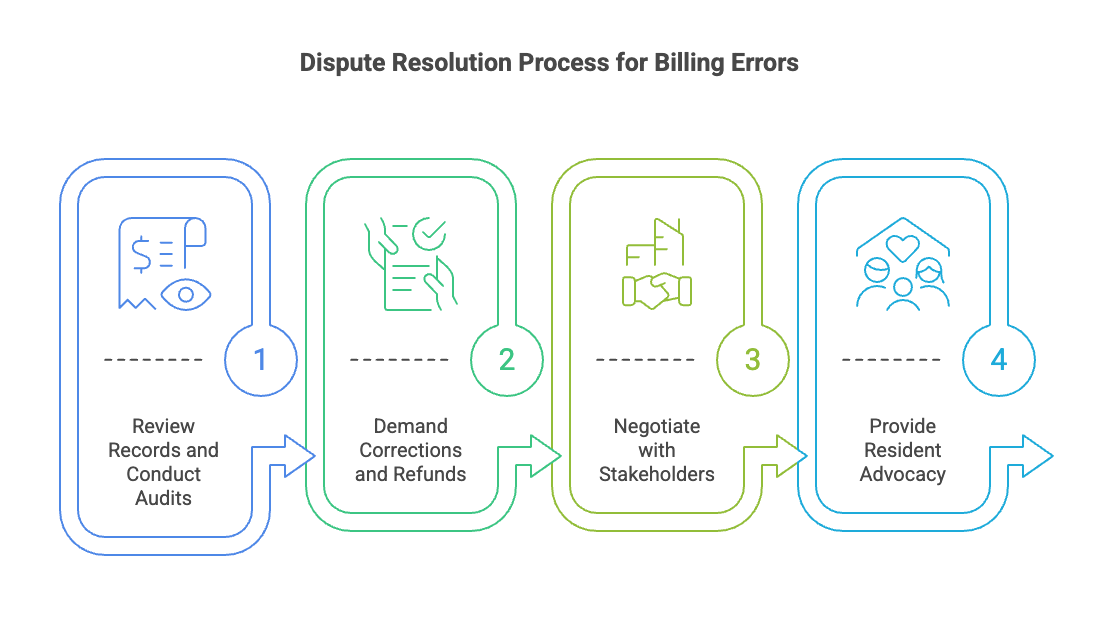

- Review records and run targeted billing audits to spot duplicate services, inflated rates, or charges for care you didn’t authorize.

- Demand corrections and refunds, send preservation letters, and negotiate with the facility, insurers, and billing vendors.

- Provide resident advocacy by coordinating with family, care teams, and regulators so your loved one’s needs remain at the center while the dispute is resolved.

You’ll get clear next steps, help gathering statements and contracts, and a plan that protects resources you can keep using to serve others.

Long Term Effects of Fort Lauderdale Nursing Home Unauthorized Charges / Billing Fraud Injuries

When a Fort Lauderdale nursing home hits you with unauthorized charges or billing fraud, you can face prolonged financial hardship that drains your savings and limits your options.

You may also carry lasting emotional distress as you question what else was mishandled and struggle to regain trust.

Worse, the facility may cut corners, and you can end up with a reduced quality of care when resources get redirected away from your loved one’s needs.

Prolonged Financial Hardship

Unauthorized charges at a Fort Lauderdale nursing home don’t just drain an account—they can trigger prolonged financial hardship that lingers for months or years. You may face depleted savings, missed rent or mortgage payments, and reduced funds for your loved one’s medications, therapies, or transportation.

When bills pile up, you’re forced to delay other caregiving needs and community commitments you care about.

You can protect your family by documenting every charge, requesting itemized statements, and disputing suspicious line items in writing. A billing fraud lawyer can help you pursue refunds, stop ongoing withdrawals, and support your financial recovery through claims and negotiations.

While the case moves forward, use practical budgeting strategies: set up alerts, separate care funds, prioritize necessities, and review accounts weekly to catch new discrepancies fast.

Lasting Emotional Distress

Even after you stop the improper withdrawals, billing fraud at a Fort Lauderdale nursing home can leave lasting emotional distress that doesn’t fade quickly. You may replay statements, receipts, and phone calls, wondering what you missed and who else is at risk.

That constant vigilance can grow into chronic anxiety, disrupting sleep and making everyday decisions feel unsafe.

You might also feel guilt for not catching the scheme sooner, even though the wrongdoing isn’t yours. When you’re trying to advocate with compassion, betrayal hits harder, and it can spill into relationship strain with siblings or other caregivers over next steps, trust, and boundaries.

If you’re serving a loved one, protect your own well-being, document concerns, and seek support so you can keep showing up with steady care.

Reduced Quality Of Care

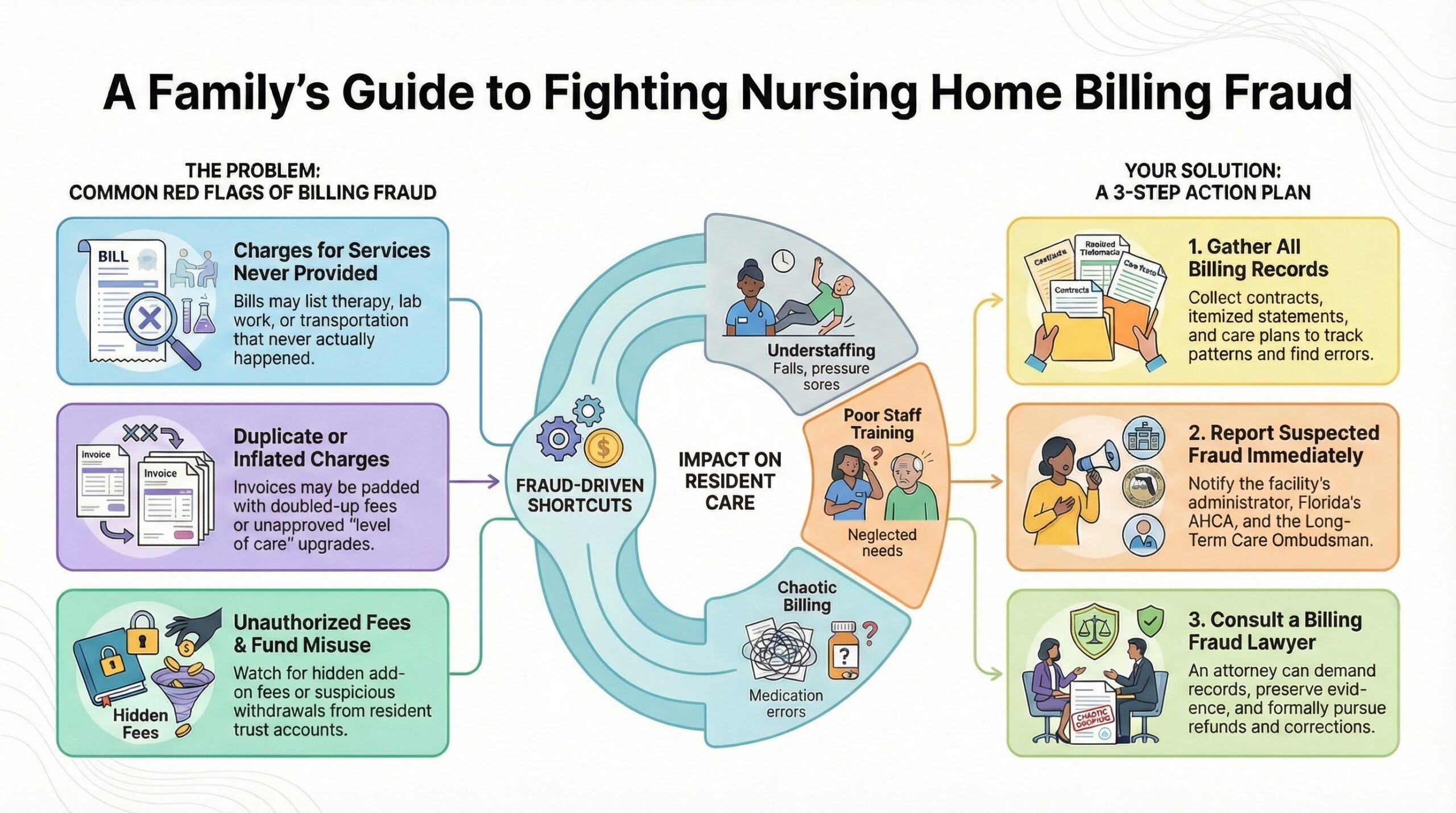

Although the charges may look like a “billing issue” on paper, nursing home fraud often leads to reduced quality of care because it drains funds, attention, and accountability from your loved one’s essential day-to-day needs.

When money disappears, the facility cuts corners—fewer aides on shift, rushed hygiene, delayed meals, and skipped mobility support. You may also see weakened staff training, which increases turnover and leaves caregivers unprepared to notice subtle decline. Sloppy processes can trigger medication errors, missed vitals, and ignored care plans.

If you’re serving an elder with dignity, you’ll want clear records and timely responses.

| Fraud-driven shortcut | Care impact |

|---|---|

| Understaffing | Falls, pressure sores |

| Poor staff training | Neglected needs |

| Chaotic billing | Medication errors |

Proving Liability in Fort Lauderdale Nursing Home Unauthorized Charges / Billing Fraud Cases

Start by pinpointing exactly who approved the charges and who benefited from them, because proving liability in a Fort Lauderdale nursing home billing fraud case hinges on linking the improper billing to a specific decision-maker.

You’ll want signatures, authorization logs, phone recordings, portal access records, and payer communications that show who initiated, altered, or confirmed billing entries. Track where the money went, including related vendors, management bonuses, or affiliated entities.

Next, preserve records with a clean Chain of custody so the facility can’t claim the documents were altered or incomplete. Request itemized statements, care plans, medication administration records, and service logs, then compare them to what was actually provided.

Use timelines to connect patterns of inflated codes, duplicate charges, or “ghost” services to specific staff roles and supervisors.

Finally, use Expert testimony from billing auditors or geriatric care professionals to explain standard practices and why the charges were unauthorized or medically unsupported.

Compensation for Fort Lauderdale Nursing Home Unauthorized Charges / Billing Fraud Damages

Once you’ve shown that the charges were unauthorized or inflated, you can pursue compensation that puts the resident and family back where they should’ve been financially. You may seek Financial restitution for every improper line item: duplicate room-and-board fees, phantom therapy sessions, medication markups, and unauthorized “level of care” upgrades.

You can also demand reimbursement for late fees, collection costs, and any penalties that are charged to a resident’s account or credit.

If the fraud forced you to drain savings, delay needed care, or lose benefits, you can pursue recovery for those related losses, too. When a facility’s conduct was intentional, you may request additional damages to discourage repeat misconduct and protect other residents.

Compensation isn’t only about dollars. You can ask for support tied to Emotional recovery when billing abuse causes anxiety, sleeplessness, or fear of speaking up. By holding the facility accountable, you help restore dignity and safeguard others in Fort Lauderdale.

The Statute of Limitations for Fort Lauderdale Nursing Home Unauthorized Charges / Billing Fraud Cases

Because billing fraud can hide in monthly statements for years, you don’t want to wait to learn how Florida’s statute of limitations applies to unauthorized nursing home charges in Fort Lauderdale. The time you have to take action depends on the legal theory involved, but statute limits can cut off recovery even when the harm feels ongoing.

Start by pinpointing when the improper charges occurred, when you first discovered them, and whether the conduct continued over multiple billing cycles.

You should also watch for “discovery” rules and tolling issues that may pause the clock, such as concealment, incapacity, or delayed access to records. Still, don’t assume extra time applies; courts can enforce strict filing deadlines.

To protect the resident and honor your duty of care to family and community, gather statements, admission contracts, and EOBs now, request full account ledgers in writing, and document each disputed line item with dates, amounts, and explanations.

Why You Need an Experienced Fort Lauderdale Nursing Home Unauthorized Charges / Billing Fraud Lawyer

Although unauthorized nursing home charges can look like harmless “adjustments” on a statement, an experienced Fort Lauderdale billing fraud lawyer knows how to trace the money, lock down the records, and press the right legal claims before deadlines and missing paperwork erase your leverage.

You need that experience because facilities often bury add-ons in dense contracts, third-party vendor invoices, and rolling “care level” changes that families never approved.

When you act quickly, your lawyer can demand itemized ledgers, preserve electronic billing logs, and compare charges to care plans and Medicare/Medicaid rules to push real billing transparency.

You’ll also gain a buffer between you and administrators who may pressure you to accept credits instead of accountability.

With strong resident advocacy, you can protect a vulnerable loved one while seeking repayment, statutory damages where available, and policy changes that prevent future overbilling of other residents and families, too.

How to Choose the Right Fort Lauderdale Nursing Home Unauthorized Charges / Billing Fraud Lawyer for Your Case

When you’re staring at confusing line-item fees and “care level” increases you never authorized, you need a Fort Lauderdale nursing home billing fraud lawyer who can move fast and prove where the money went.

Start by choosing someone who listens to your loved one’s story with dignity and treats the case as a mission to protect vulnerable residents.

Ask about experience with nursing home contracts, Medicaid/Medicare coordination, and common add-on charges.

In client consultations, you should get a clear plan: what records they’ll request, who they’ll interview, and how they’ll trace payments and approvals.

Demand fee transparency up front—how costs, contingency fees, and potential recovery work—so you can serve your family without financial surprises.

Look for prompt communication, a track record of resolving disputes, and comfort working with investigators and accountants.

You’ll know you’ve found the right fit when they explain options plainly and act quickly.

About the Law Offices of Anidjar and Levine

After you’ve identified what to look for in a Fort Lauderdale nursing home billing fraud lawyer, you may want to learn more about the team you’d trust with your family’s case.

At the Law Offices of Anidjar and Levine, you work with people who treat elder advocacy as a responsibility, not a transaction.

You’ll get straightforward guidance, timely updates, and a plan built around protecting vulnerable residents.

You can review client testimonials to see how the firm supports families through stressful investigations, disputed invoices, and recovery efforts.

You’ll also find staff credentials that reflect rigorous training and a commitment to ethical practice.

The team gathers billing records, consults qualified professionals when needed, and holds accountable while respecting your loved one’s dignity.

You won’t have to chase answers—your questions get addressed promptly, and your goals stay at the center of every decision.

Frequently Asked Questions

Can Medicare or Medicaid Reimburse Fraudulent Nursing Home Charges?

Medicare or Medicaid usually won’t reimburse you for fraudulent nursing home charges, but you can seek Medicare reimbursement corrections and dispute improper claims.

You’ll often need to report the fraud, request itemized statements, and file appeals promptly.

If Medicaid paid, the agency may pursue recovery while reviewing your Medicaid eligibility and coverage dates.

You can also ask the facility for refunds and document everything so you protect the resident and support accountable care.

What Documents Should I Request From the Facility’s Billing Department?

Request copies of the resident agreement, rate sheet, and any addenda. Request itemized invoices for each billing period, including medications, therapies, supplies, and ancillary services. Get your full account ledger with dates, CPT/HCPCS codes, adjustments, credits, and refunds. Request insurance explanations (EOBs) from Medicare/Medicaid and any secondary insurer. Request prior authorizations, consent forms, and notes supporting each charge so you can advocate wisely for your loved one.

Can I Dispute Charges While My Loved One Remains in the Facility?

Yes, you can dispute charges while your loved one remains in the facility. You should notify billing in writing, request an itemized statement, and mark contested line items as payment disputes.

You can keep paying undisputed amounts to avoid service interruptions, and document every call, email, and receipt.

Use family advocacy by involving the care team, ombudsman, and insurance/Medicare contacts. If pressure continues, ask for a supervisor review and deadlines.

How Do I Report Billing Fraud to Florida State Agencies?

Report billing fraud by calling Florida’s state hotline and filing an online complaint with the Attorney General’s consumer protection office.

You’ll gather invoices, EOBs, contracts, and dated notes, then submit a clear timeline and amounts.

You can also report to AHCA for facility billing issues and the Department of Financial Services for insurance-related fraud.

If Medicaid is involved, contact Florida Medicaid’s fraud unit.

Keep copies and follow up regularly.

Will Contesting Charges Affect My Loved One’s Care or Room Assignment?

Contesting charges shouldn’t affect your loved one’s care or room assignment, and facilities can’t retaliate for raising concerns. You can protect care continuity by keeping communication respectful, documenting every interaction, and requesting written confirmation of services and billing.

If staff threaten room transfers or changes in treatment, escalate to the administrator and the ombudsman, and ask for a care-plan meeting. You’re advocating with integrity, not causing trouble for anyone.

——————–

If you’re facing unauthorized charges or billing fraud at a Fort Lauderdale nursing home, you don’t have to handle it alone.

The Law Offices of Anidjar and Levine can help you protect your loved one, challenge improper fees, and pursue the money you’re owed.

Act quickly to preserve records, report suspicious charges, and strengthen your claim before deadlines expire.

With an experienced Fort Lauderdale Nursing Home Abuse and Neglect Lawyer on your side, you can understand your options and take decisive steps toward accountability and financial recovery. Help is available now.