If you suspect nursing home financial abuse in Fort Lauderdale, you can act fast to stop losses and protect your loved one.

Lock down bank access, change shared passwords, and save statements, receipts, and check images to build a clear timeline.

Ask the facility for a written incident report and document names and dates.

A Fort Lauderdale nursing home financial abuse lawyer at the Law Offices of Anidjar and Levine can preserve evidence, freeze access, and pursue recovery through regulators or the court.

You can also review your options with a Fort Lauderdale Nursing Home Abuse and Neglect Lawyer to learn about crucial signs of abuse and your next steps.

Key Takeaways

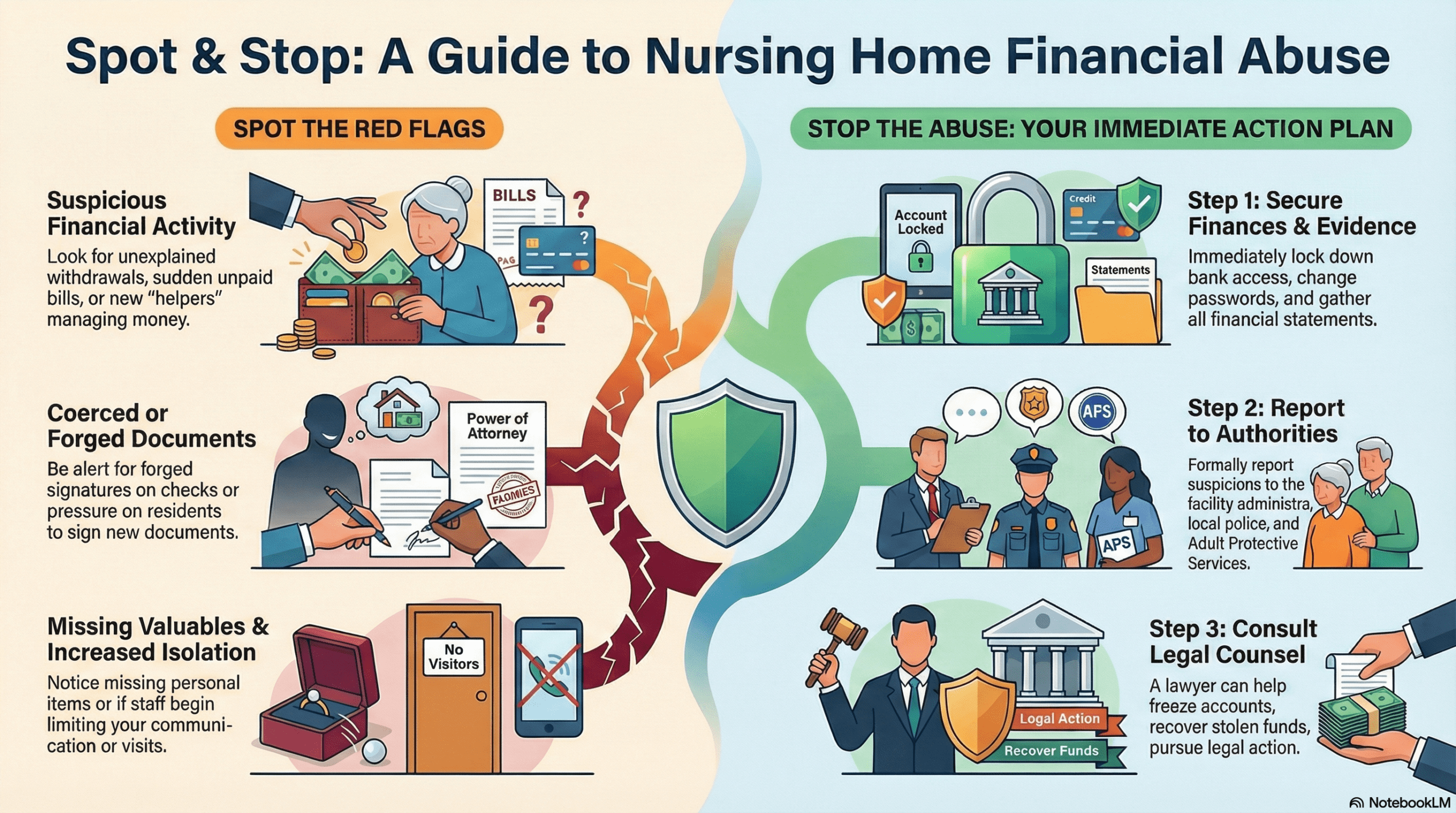

- Watch for red flags like unexplained withdrawals, missing valuables, forged signatures, or new “helpers” pressuring for PINs or documents.

- Act fast: secure statements, receipts, POA papers, and incident reports; freeze passwords and stop withdrawals through the bank and facility.

- Preserve evidence by requesting itemized billing, check images, cash-handling policies, and keeping a dated log of who accessed accounts or documents.

- Report suspected abuse to the facility administrator, Fort Lauderdale Police, Florida Adult Protective Services, and AHCA, using anonymous reporting if retaliation is feared.

- A Fort Lauderdale nursing home financial abuse lawyer can send preservation letters, seek court orders, recover stolen funds, and challenge coerced transfers or forged “gifts.”

How We Can Help With Your Fort Lauderdale Nursing Home Financial Abuse Claim

Take action before more money disappears. You can protect your loved one’s dignity and resources by getting focused legal help right away.

You’ll get a clear plan, quick next steps, and steady guidance so you can keep serving your family without feeling overwhelmed.

You can have us gather records, track suspicious transfers, and preserve crucial evidence. You’ll understand what to document, who to notify, and how to stop further losses through proper notices and account safeguards.

You can also lean on us to coordinate with elder financial planning professionals to stabilize benefits, budgets, and long-term care funding.

When relatives disagree, you can use the family mediation services we arrange to reduce conflict and keep decisions centered on your loved one’s best interests. You’ll stay informed with plain-language updates, and you’ll choose each move while we handle the heavy lifting and paperwork.

Understanding Fort Lauderdale Nursing Home Financial Abuse Cases

Watch for sudden changes in banking access, missing personal items, unexplained withdrawals, new “friends” managing finances, forged signatures, or pressure to sign documents.

Be alert to banking changes, missing belongings, unexplained withdrawals, new financial “helpers,” forged signatures, or pressure to sign paperwork.

Pay attention if staff limit communication, discourage questions, or interfere with visitation rights, since isolation often hides exploitation.

Keep records, request copies of account statements and facility billing, and document conversations.

When something feels off, act quickly—early reporting can stop further loss and protect other residents from harm.

Common Causes of Fort Lauderdale Nursing Home Financial Abuses

You’ll often see nursing home financial abuse start when someone misuses a resident’s funds or siphons money through staff theft and scams.

It can also show up as forged signatures and checks that quietly drain accounts.

If someone exploits a power of attorney, they can redirect benefits and assets without your loved one’s real consent.

Misuse Of Resident Funds

When staff members dip into a resident’s accounts, financial abuse can pile up fast and stay hidden for months. You might see “convenience” charges for toiletries, rides, or outings that never happened, or unexplained withdrawals after a worker offers to “help” manage money. Even small skimming adds up when it repeats weekly.

You can protect vulnerable neighbors by insisting on clear accounting: monthly statements, itemized receipts, and written policies for handling cash, benefits, and trust accounts. If you hold family guardianship, set spending limits and require dual review for large purchases.

Stay alert for sudden changes in spending patterns, missing personal property, or pressure to move funds into risky products—warning signs that can overlap with investment fraud. Report concerns promptly and document everything.

Forged Signatures And Checks

Clear accounting can expose skimming, but forged signatures and checks let theft slip past routine reviews by making transactions look authorized. You may see sudden withdrawals, unfamiliar payees, or checks that don’t match a resident’s usual spending. Staff or outsiders might trace a resident’s name, pressure shaky hands, or copy signatures from old forms, then cash checks quickly before questions arise.

You can serve residents best by insisting on signature verification for every check, deposit slip, and bank authorization. Watch for check alteration, including changed amounts, added payees, or overwritten dates.

Compare check numbers, request images of cleared checks, and reconcile statements promptly. If anything looks off, preserve originals, document timelines, and report concerns to facility leadership and the bank immediately.

Power Of Attorney Exploitation

Although a power of attorney should protect a resident’s finances, the wrong agent can exploit it to drain accounts, redirect income, and sign away assets with a veneer of “legal” authority. You may see sudden withdrawals, new “loans,” or deed changes pushed through without meaningful consent.

Elderly coercion often hides behind family pressure, guilt, or isolation, and it can lead to quiet asset diversion that undermines a resident’s care and dignity.

| Red flag you notice | Caring step you take |

|---|---|

| A new agent appears suddenly | Request the POA document |

| Bills go unpaid | Pull account statements |

| Unexplained transfers | Ask for written accounting |

| Title/beneficiary changes | Notify the bank/registrar |

| The resident seems pressured | Document concerns, seek legal review |

Staff Theft And Scams

Financial exploitation doesn’t always come from a family agent with a power of attorney—it can also start inside the facility through staff theft and scams that target residents’ cash, cards, checks, and personal information.

You may see missing money, unexplained withdrawals, or new “friends” pressuring a resident to share PINs or sign blank checks.

Employee fraud can look like “helpful” staff offering to pay bills, then skimming change, adding extra charges, or diverting statements.

Identity theft may follow when someone copies an ID, Medicare number, or banking details, then opens accounts or reroutes benefits.

To serve and protect residents, you should document irregularities, secure valuables, request account records, and report concerns to administrators and state regulators quickly.

Acting early can stop losses and deter repeat abuse.

Legal Rights of Fort Lauderdale Nursing Home Financial Abuse Victims

When someone in a Fort Lauderdale nursing home steals or misuses your loved one’s money, you don’t have to accept it as “part of aging.” You have enforceable elder rights under Florida law, and you can seek asset protection for what was taken and what’s still at risk.

Financial abuse can violate resident-rights statutes, fiduciary duties, and criminal laws, giving you multiple paths to hold wrongdoers accountable and restore dignity.

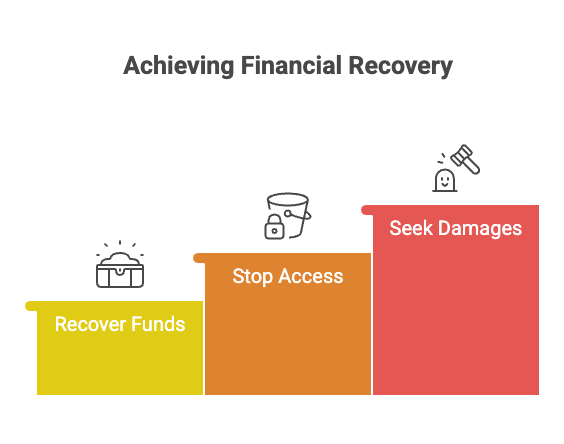

You may be entitled to pursue:

- Recovery of stolen funds, reimbursements, and repayment of unauthorized charges

- Court orders that stop further access to accounts, cards, or property

- Damages for losses and, in serious cases, attorney’s fees or punitive damages

You can also demand proper oversight from the facility and challenge wrongful transfers, forged signatures, or coercive “gifts.” By asserting these rights, you’re not just protecting assets—you’re serving a vulnerable neighbor with fairness and respect.

Steps to Take After a Fort Lauderdale Nursing Home Financial Abuse

After you suspect financial abuse in a Fort Lauderdale nursing home, secure crucial financial records like bank statements, billing invoices, and authorization forms.

Report the suspected abuse to the facility, local law enforcement, and appropriate state agencies so there’s an official record.

Then consult legal counsel to protect your loved one’s assets, preserve evidence, and pursue recovery.

Secure Financial Records

To protect your loved one’s assets and strengthen your case, secure every available financial record as soon as you suspect nursing home financial abuse in Fort Lauderdale. Gather originals, make clean copies, and store them with encrypted backups so nothing “disappears.”

Create a simple log of who handled each document and when; these audit trails can clarify timelines and protect well-meaning caregivers from false blame.

| Record to secure | Where to pull it |

|---|---|

| Bank statements | Online portal/branch |

| Credit card bills | Issuer account |

| Power of attorney | Attorney/notary |

| Facility invoices | Billing office |

| Receipts & cash logs | Wallet/files |

Freeze shared passwords, screenshot suspicious transactions, and request itemized statements. Keep everything organized so you can act quickly and serve your loved one with steady, faithful care.

Report Suspected Abuse

Start by speaking up as soon as you spot red flags, because quick reporting can stop the losses and trigger protections for your loved one.

Trust your signs detection: unexplained withdrawals, missing belongings, sudden “new friends,” or pressure to sign paperwork.

Report your concerns to the facility administrator and request a written incident report, then document dates, names, and responses.

If you believe a crime occurred, contact Fort Lauderdale Police and provide copies of your records.

You can also notify Florida Adult Protective Services and the Agency for Health Care Administration, which oversee investigations and licensing.

If you fear retaliation, ask about anonymous reporting options and keep your loved one’s dignity at the center.

Follow up until you receive confirmation that the case has been opened.

Consult Legal Counsel

Once you’ve reported your concerns and secured basic documentation, talk with a Fort Lauderdale nursing home financial abuse lawyer who can protect your loved one’s rights and money. You’ll get guidance on preserving evidence, stopping further withdrawals, and notifying banks and administrators the right way. Your lawyer can request records, interview staff, and coordinate with law enforcement or regulators so your report doesn’t stall.

You can also explore alternative remedies, such as restitution demands, civil claims, or guardianship actions that limit an abuser’s access. Ask your counsel to recommend preventive measures like tighter account controls, power-of-attorney review, and ongoing monitoring. When you act quickly and compassionately, you help your loved one regain stability and you deter harm to other residents too.

How a Fort Lauderdale Nursing Home Financial Abuse Lawyer Can Help You

Protect your loved one’s savings by bringing in a Fort Lauderdale nursing home financial abuse lawyer who knows how these schemes unfold and how to stop them.

You’ll get a steady advocate who acts quickly, treats your family with dignity, and keeps your focus on care, not conflict.

Your lawyer investigates accounts, authorizations, and facility practices to spot Elder fraud and secure evidence before it disappears.

They can also coordinate with banks, adult protective services, and the nursing home to halt suspicious withdrawals and preserve benefits.

When tensions rise, your lawyer can guide Family mediation so everyone aligns on what’s best for your loved one while still protecting their rights.

Expect help that’s practical and service-minded, such as:

- Reviewing powers of attorney, signature cards, and billing statements for red flags

- Sending preservation letters, subpoenas, and demand notices to recover funds

- Filing civil claims and seeking court orders to freeze assets and enforce oversight

Long-Term Effects of Fort Lauderdale Nursing Home Financial Abuse Injuries

When you’re hit by nursing home financial abuse in Fort Lauderdale, you can face chronic financial instability that lingers long after the theft.

You may also experience declining mental well-being as stress, fear, and betrayal build over time.

And when money meant for necessities goes missing, you can end up with reduced quality of care that affects your health and safety.

Chronic Financial Instability

| What you see | What it does to you |

|---|---|

| Empty checking | Missed bills, late fees |

| Altered statements | Time spent untangling records |

| New “subscriptions” | Ongoing leaks in cash flow |

You can’t serve others well if your finances stay in crisis. Act quickly to freeze accounts, document losses, and pursue recovery to restore stability.

Declining Mental Well-Being

Financial abuse doesn’t stop at bounced payments and drained accounts—it can also wear down your mind long after the money’s gone. When you realize someone exploited your trust, anxiety can spike, sleep can suffer, and concentration can fade.

You may second-guess every decision, even small choices, because the betrayal rewires how safe the world feels.

Over time, that constant stress can accelerate cognitive decline, especially when it pairs with isolation and shame.

You might stop joining group activities, avoid phone calls, or sit quietly through visits—signs of emotional withdrawal that loved ones may misread. If you’re committed to serving others, you may also feel guilt for “being a burden,” which deepens depression.

Naming these effects helps you seek counseling, rebuild confidence, and restore your sense of dignity.

Reduced Quality Of Care

Too often, financial exploitation in a nursing home quietly leads to reduced quality of care because unpaid bills, missing benefits, or sabotaged accounts can cut off what you need to stay stable. When funds vanish, you may lose therapy sessions, proper nutrition, and timely transportation, and the team may stretch thin, fueling staff burnout and rushed routines that invite medication errors. You can still advocate with steady compassion, asking clear questions and documenting gaps.

| What gets disrupted | How it shows up |

|---|---|

| Care supplies | Wounds heal more slowly, and hygiene slips |

| Clinical oversight | Missed vitals, delayed follow-up |

| Support services | Fewer activities, isolation grows |

Proving Liability in Fort Lauderdale Nursing Home Financial Abuse Cases

Build a strong case by showing who took advantage of the resident, how they did it, and what your loved one lost as a result.

Start with evidence preservation: secure bank statements, credit card records, admission contracts, care logs, call logs, texts, emails, and any power-of-attorney papers before they disappear.

Start with evidence preservation: secure bank and card records, contracts, care logs, calls, texts, emails, and POA papers before they disappear.

Request the resident’s chart and facility policies, and note any gaps, altered entries, or sudden “missing” documents.

Then use witness interviews to connect the dots. Speak with aides, nurses, administrators, roommates, visitors, and the resident if they can share details.

Ask who handled cash, controlled mail, or drove the resident to banks, and who benefited from new accounts or unusual purchases.

Track timelines and compare signatures, PIN use, and authorization limits.

If the facility ignored red flags or failed supervision, document prior complaints, training lapses, and reporting failures.

You help protect others by insisting on accountability.

Compensation for Fort Lauderdale Nursing Home Financial Abuse Damages

Once you’ve shown who exploited your loved one and how the loss happened, the next step is to pursue compensation that restores what was taken and addresses the harm the abuse caused. You can seek repayment of stolen funds, reimbursement for improper fees, and recovery for property transferred under pressure or deception. You may also pursue damages tied to the fallout—costs to secure accounts, replace benefits, and hire fiduciaries or guardians to stabilize care.

To document the true scope, you’ll often rely on elder financial forensics to trace withdrawals, identify forged signatures, and map transactions to specific actors. Those findings support clear restitution estimates that show not only what was left in the account, but what should’ve remained available for dignity, safety, and quality care.

In some cases, you can request court orders that freeze assets, unwind transfers, and require ongoing reporting.

Your focus stays service-centered: restoring resources so your loved one’s care comes first.

The Statute of Limitations for Fort Lauderdale Nursing Home Financial Abuse Cases

Because financial exploitation in a nursing home often stays hidden behind “routine” paperwork and quiet account changes, the statute of limitations can start running before you realize anything’s wrong. In Fort Lauderdale, you’ll need to track when you discovered (or should’ve discovered) suspicious withdrawals, new “authorized” users, or coerced signatures.

These statute nuances matter because different legal theories can trigger different filing deadlines, and delay can also risk lost records or fading witness memory. You serve your loved one best by documenting quickly, requesting account histories, and preserving facility communications.

| Trigger event | What you do | Why it matters |

|---|---|---|

| First irregular charge | Save statements, alerts | Establish discovery timeline |

| Power of attorney change | Get copies, note dates | Shows possible undue influence |

| Missing valuables/cash | File incident reports | Creates contemporaneous proof |

| Bank/APS referral | Record contacts, outcomes | Supports diligence and notice |

Why You Need an Experienced Fort Lauderdale Nursing Home Financial Abuse Lawyer

Statute-of-limitations rules can move faster than you expect, so you don’t want to spend months guessing which deadline applies while money keeps disappearing. An experienced Fort Lauderdale nursing home financial abuse lawyer helps you act quickly, preserve records, and stop further loss through targeted legal demands and court orders. You’ll also avoid missteps that tip off wrongdoers or weaken later claims.

You need counsel who knows how facilities, insurers, and banks respond, and who can coordinate Financial audits to trace unauthorized transfers, forged checks, and sudden “fees.” When a resident can’t safely manage accounts, your lawyer can guide the elderly guardianship steps, petition for emergency authority, and challenge the exploitative powers of attorney.

You’ll get a clear plan for collecting evidence, interviewing staff, securing surveillance, and working with law enforcement when appropriate. That focused support lets you protect dignity, restore stability, and serve your loved one well.

How to Choose the Right Fort Lauderdale Nursing Home Financial Abuse Lawyer for Your Case

Even if you’re worried about confrontation or cost, you can choose the right Fort Lauderdale nursing home financial abuse lawyer by focusing on experience, responsiveness, and a clear strategy.

Start by confirming Attorney experience with nursing home financial exploitation, including cases involving POA misuse, unauthorized transfers, and account takeovers. Ask how they’ll protect your loved one while pursuing recovery and reporting misconduct.

Use Client interviews to gauge fit: ask who’ll handle your file day to day, how often you’ll get updates, and how quickly they return calls. Request a plain-language plan that lists immediate steps, needed records, and likely timelines.

Make sure they explain fees in writing and outline what you can do now, like freezing accounts and preserving statements. Finally, choose someone who treats your role as an advocate with respect and keeps your goal—safeguarding dignity—at the center of every decision.

About the Law Offices of Anidjar and Levine

After you’ve narrowed your options and know what to ask, you may want to learn what the Law Offices of Anidjar and Levine offers families facing nursing home financial exploitation in Fort Lauderdale.

You get a team that listens, treats your loved one with dignity, and pursues accountability for those who took advantage of trust.

You’ll work with attorneys who handle the investigation, gather records, and coordinate with financial and medical sources to document losses and patterns of abuse.

You can expect clear updates, timely callbacks, and a plan that fits your goals—whether you want repayment, protective orders, or broader changes that prevent future harm.

The firm’s culture supports service beyond the case through community outreach and staff training, helping caregivers and advocates recognize red flags early.

If you’re ready to act, you can request a consultation and take a practical step toward restoring security and peace.

Frequently Asked Questions

Do I Need Probate to Recover Stolen Assets From a Deceased Resident?

You don’t always need probate to recover stolen assets, but you often do.

Probate necessity depends on whether the assets belonged to the resident individually and whether you must act through the estate’s personal representative.

If you can trace funds and the estate already has authority, you may pursue recovery via estate litigation or civil claims.

To serve the resident’s legacy well, you’ll want counsel to confirm standing and deadlines.

Can Banks Reverse Unauthorized Nursing Home-Related Withdrawals or Wire Transfers?

Yes, banks can sometimes reverse unauthorized nursing home-related withdrawals or wire transfers, but you’ve got to act fast.

You should notify the bank immediately, dispute the transaction in writing, and request a fraud investigation.

Bank liability depends on how the transfer occurred and whether you reported it promptly.

Ask for the bank’s reversal timelines, hold confirmations, and any provisional credits.

Will Medicaid Eligibility Be Affected if Stolen Funds Are Later Recovered?

Yes—Medicaid eligibility can be affected, but you can often correct it once stolen funds are recovered. You’ll need to report the recovery promptly, document theft, and request Medicaid restoration if benefits were reduced or denied.

Recovery timelines matter: a late recovery may trigger temporary ineligibility or repayment, while a timely one may limit disruption. You should work with your caseworker, keep records, and advocate for fair treatment.

Can Out-Of-State Family Members Sign Documents to Start a Florida Case?

Yes, you can start a Florida case even if you live out of state, but you’ll need proper authority. If you hold a valid power of attorney, you can usually sign critical documents remotely, often with notarization.

You must still satisfy Florida filing rules and address jurisdictional challenges, such as where the harm occurred and which parties are involved. You’ll protect your loved one by carefully coordinating signatures.

Are Arbitration Clauses in Admission Contracts Enforceable in Financial Abuse Claims?

Yes, arbitration clauses in admission contracts can be enforceable in financial abuse claims, but you can still contest them. You’ll evaluate the enforceability of arbitration by checking who signed, the resident’s capacity, disclosure, and fairness.

You can raise waiver challenges if the facility delayed, acted inconsistently, or limited your rights. If you’re serving a loved one, you’ll gather records and timelines to push for court access when justice requires it.

———————-

You don’t have to face nursing home financial abuse in Fort Lauderdale alone.

If you notice missing funds, unexplained withdrawals, forged signatures, or sudden changes to bank accounts or legal documents, you should act quickly to protect your loved one and preserve vital evidence.

You have the right to demand answers, report suspected misconduct, and pursue compensation under Florida law.

With an experienced Fort Lauderdale Nursing Home Abuse and Neglect Lawyer from the Law Offices of Anidjar and Levine on your side, you can understand your legal options, meet critical deadlines, and fight for justice and accountability.