You need a Fort Lauderdale PIP claims injury lawyer who moves quickly to protect no-fault benefits, meet Florida’s 14-day treatment rule, and prevent costly delays.

The Law Offices of Anidjar and Levine sets up your claim, verifies coverage, organizes medical records and billing, and fights reductions, denials, or coding errors.

We coordinate benefits, track deadlines, and submit compliant proofs to secure payment for necessary care and lost wages.

We also challenge improper insurer tactics and pursue statutory interest when warranted, and the next sections explain how this works for your case. Learn more here: Fort Lauderdale Car Accident Lawyer

Key Takeaways

- We handle Fort Lauderdale PIP claims end‑to‑end: claim setup, adjuster communication, deadlines, and complete proof‑of‑loss submissions.

- We coordinate medical care and documentation, verify billing codes, and dispute reductions to maximize PIP benefits within policy limits.

- We track wage-loss, mileage, attendant care, and replacement services, and challenge improper denials with statutory demands.

- We manage liens, coordinate PIP with health insurance or MedPay, and prevent duplicate payments when limits near exhaustion.

- We preserve evidence and treatment continuity to establish causation, avoiding gaps insurers use to deny or limit benefits.

How We Can Help With Your Fort Lauderdale PIP Claims Claim

Manage your PIP claim with confidence by leveraging our focused experience in Fort Lauderdale’s no-fault insurance system. You receive disciplined guidance at every stage, from initial intake to final resolution, so you can stay centered on healing and serving your family and community.

We organize your records, verify coverage, and present precise demands that reflect your documented losses and necessary care.

We coordinate directly with providers to address medical liens, reduce unnecessary charges, and prevent avoidable delays. You’ll understand each step, including projected settlement timelines, expected documentation, and negotiation milestones.

We respond promptly to insurer requests, challenge improper denials, and escalate matters when leverage is required.

Our approach emphasizes accuracy, transparency, and momentum. We track deadlines, preserve evidence, and communicate outcomes in clear and concise terms.

You gain a clear plan, calibrated to your needs and obligations, that protects benefits while safeguarding your rights.

With our steady advocacy, you move forward with order, confidence, and measurable progress.

Understanding Fort Lauderdale PIP Claims Cases

With a clear plan in place, the next step is understanding how Fort Lauderdale PIP claims actually work under Florida’s no-fault framework.

You’ll first notify your insurer promptly, then document treatment, expenses, and lost income. PIP generally pays a portion of reasonable medical costs and a percentage of wages, regardless of fault, up to policy limits. Timeliness is crucial, as delays can reduce benefits or trigger disputes.

You should gather complete medical records, bills, and provider statements to establish necessity and causation.

Submit detailed proof-of-loss forms and track communications with adjusters. If the insurer challenges reasonableness, coding, or causation, respond with organized documentation and, when needed, expert support. Coordinate benefits carefully when multiple coverages apply to avoid duplicate payments.

When bills threaten to exceed policy limits, prioritize necessary care, and explore secondary sources such as health insurance or MedPay. If underpayment or denial occurs, use statutory demand procedures, request reconsideration, and escalate to litigation only when negotiations fail.

Common Causes of Fort Lauderdale PIP Claims

You’re likely to encounter PIP claims arising from rear-end collisions, intersection accidents, distracted driving crashes, and weather-related hazards.

You must recognize how each scenario creates distinct injury patterns and documentation needs, which directly affects coverage, medical billing, and timelines.

Rear-End Collisions

Coming out of nowhere, rear-end collisions are among the most frequent triggers of Fort Lauderdale PIP claims, often stemming from tailgating, distracted driving, abrupt braking, and adverse weather that reduces stopping distances. You prioritize safety, yet another driver’s inattention can leave you with neck and back injuries, headaches, and costly vehicle repairs.

After securing the scene, seek prompt medical care and request a thorough whiplash assessment, even if pain seems minor, because soft-tissue injuries often emerge later.

Document the damage carefully, including photos of bumper damage, trunk misalignment, and any fluid leaks. Exchange information, gather witness statements, and notify your insurer without delay. PIP benefits can cover medical expenses and a portion of lost wages, but timely filings, accurate records, and consistent treatment notes strengthen your claim.

Intersection Accidents

Navigating Fort Lauderdale’s busy intersections exposes drivers, cyclists, and pedestrians to high-risk conflict points where visibility, timing, and right-of-way decisions converge.

You face converging traffic streams, intricate turn phases, and sudden lane changes that increase the likelihood of an impact.

Inadequate signal timing, poorly marked crosswalks, and blind intersections reduce reaction windows and invite dangerous assumptions about who may proceed.

When vehicles accelerate to clear yellow lights or execute hurried left turns, angles of collision increase and injuries intensify.

You can serve your community by approaching each intersection with deliberate caution, scanning for hidden hazards, and yielding when doubt arises.

Please ensure that you document the scene promptly, noting the light phases, lane controls, and any obstructed sightlines.

These details help validate fault, preserve your PIP benefits, and protect injured passengers and pedestrians.

Distracted Driving Crashes

Often overlooked until a crash occurs, distracted driving remains a leading catalyst for Fort Lauderdale PIP claims because it compromises perception, decision-making, and reaction time in seconds. When serving others—whether family, clients, or community—you must recognize how quickly attention can drift.

Mobile phones, infotainment systems, and in-vehicle alerts divert eyes and cognition, transforming routine trips into high-risk moments. Even hands-free calls split focus, while texts, navigation inputs, and app notifications create layered distractions.

After a collision, prompt medical evaluation protects your health and PIP benefits, documenting symptoms that might surface later. Preserve evidence by photographing the scene, securing witness statements, and saving phone records if relevant.

Report the claim quickly, avoid speculative statements, and follow treatment plans. These disciplined steps support coverage and strengthen your legal position.

Weather-Related Hazards

While distraction inside the cabin can spark a crash in seconds, South Florida’s weather reshapes road risk even when you’re focused. Sudden downpours reduce visibility, extend stopping distances, and conceal hazards. Seasonal flooding obscures lane markings, hides potholes, and can stall engines, leaving you exposed to secondary collisions.

Gusty squalls push vehicles sideways, while windborne debris shatters glass, punctures tires, or forces abrupt evasive actions.

You mitigate harm by slowing before storms, increasing following distance, and avoiding standing water when depth is uncertain. Use headlights, maintain wiper blades and tires, and plan routes that avoid flood‑prone corridors. After any weather‑related crash, seek prompt medical care and document conditions.

PIP benefits may cover treatment and lost wages, but timely notice and meticulous records strengthen your claim.

Legal Rights of Fort Lauderdale PIP Claims Victims

Because Florida’s no-fault system governs most auto injuries, your PIP rights in Fort Lauderdale hinge on strict rules that protect prompt access to medical care and wage replacement. You’re entitled to reasonable and necessary treatment within defined deadlines, and insurers must process claims in good faith.

Your Patient rights include clear explanations of benefits, appeal options for denials, and timely reimbursement.

Privacy protections apply to your medical records, limiting disclosures to what’s required to adjust the claim.

- You may select qualified providers, authorize limited releases, and challenge overbroad requests for records, ensuring dignity and confidentiality during recovery.

- You’re entitled to a portion of lost wages, transportation to treatment when covered, and reimbursement for medically necessary services, subject to policy limits and statutory percentages.

- If an insurer delays, underpays, or unreasonably denies benefits, you can demand compliance, seek statutory interest, and pursue attorney’s fees, reinforcing accountability and fairness under Florida law.

Steps to Take After a Fort Lauderdale PIP Claims

After a crash, you should seek immediate medical care to protect your health and establish timely records that support your PIP claim.

Next, notify your insurer promptly, following policy deadlines and providing accurate initial information without speculating about fault or injuries.

Finally, document and preserve evidence by saving medical records, bills, photos, witness details, and repair estimates, ensuring each item is organized and date-stamped.

Seek Immediate Medical Care

From the moment the collision occurs, prompt medical care protects both your health and your PIP claim. You should seek an urgent evaluation, even if symptoms seem minor, because adrenaline can mask injuries. Early documentation links your condition to the crash, supports accurate diagnosis, and prevents gaps that insurers may scrutinize.

Select a qualified provider, describe all symptoms accurately, and follow their recommendations precisely.

Establishing a clear treatment timeline demonstrates responsibility and preserves benefits. Attend follow-ups, comply with imaging or referral to a consultant, and keep copies of records, prescriptions, and bills. If you serve others daily, you can’t afford lingering injuries that compromise your ability to help.

Prioritize recovery now, schedule the first available appointment, and continue care until released by your healthcare provider, ensuring that your medical needs remain clearly substantiated.

Notify Insurer Promptly

Begin the claims process promptly by notifying your PIP insurer as soon as possible, ideally within 24 hours. Early notification signals diligence, protects your eligibility, and sets a cooperative tone with the adjuster. Provide the date, time, and location of the crash, your policy number, and a concise description of injuries.

Report only factual, known information, and avoid speculation about fault or long-term diagnoses.

Prompt notice supports claim denial prevention by aligning with policy deadlines and statutory requirements common in Fort Lauderdale PIP claims. Ask for a claim number, the adjuster’s contact details, and a summary of next steps, including medical billing procedures.

Please confirm your preferred communication methods and note any necessary forms or authorizations that need to be completed. Timely communication reduces administrative delays and preserves your benefits.

Document and Preserve Evidence

Lock in the facts early by capturing clear, contemporaneous evidence that supports your PIP claim and withstands scrutiny. Photograph the vehicles, roadway, weather, and visible injuries, then record names, phone numbers, and concise witness statements.

Save dashcam files, 911 audio, and surveillance clips to ensure prompt download and prevent overwriting.

Preserve medical proof with dated treatment records, diagnostic images, prescriptions, and billing statements. Keep a pain and limitations journal, noting how the injury affects work and caregiving. Maintain a clear chain of custody for physical items, labeling when, where, and by whom each item was collected and transferred.

Use digital preservation best practices: store originals, create read-only copies, and maintain secure, timestamped backups. Don’t alter metadata. Share materials only through secure, documented channels.

How a Fort Lauderdale PIP Claims Injury Lawyer Can Help You

Although PIP benefits are designed to pay quickly, a Fort Lauderdale PIP claims injury lawyer can streamline the process, protect your rights, and maximize your recovery. You’ll receive disciplined guidance from intake to payment, ensuring every form, deadline, and coverage issue is addressed with precision.

Your attorney coordinates medical documentation, verifies billing codes, and challenges improper denials, so your treatment is timely and fully supported.

With strategic communication, your claim moves forward efficiently, while you focus on healing and serving those who depend on you.

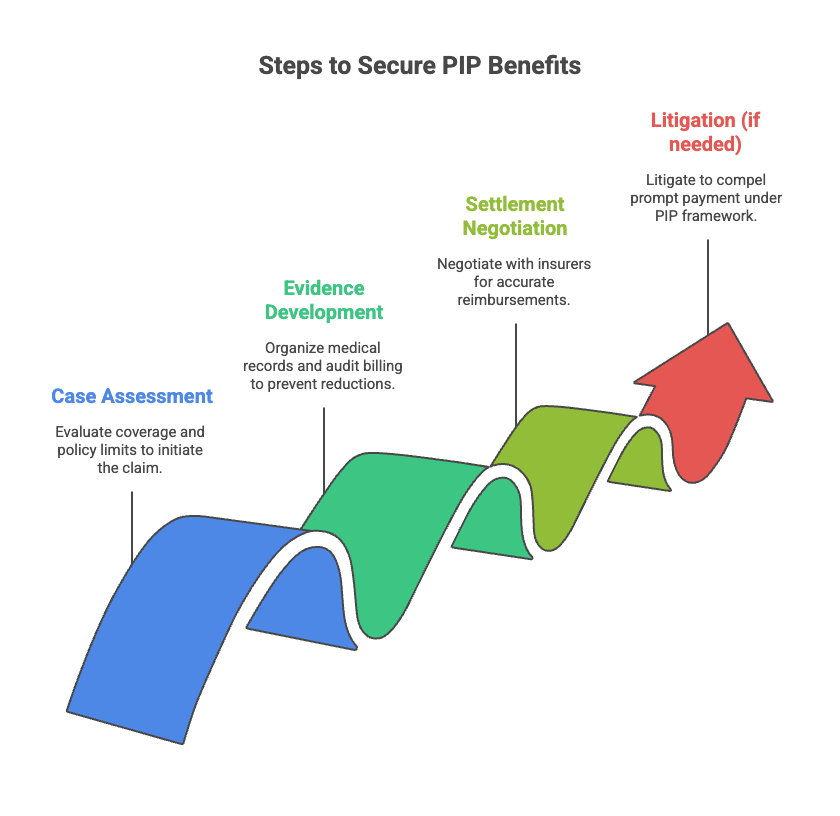

- Case assessment and claim setup: The lawyer evaluates coverage, fault-neutral issues, and policy limits, then initiates the claim with complete, compliant filings.

- Evidence development and billing audits: Counsel organizes medical documentation, disputes coding errors, and aligns records with statutory requirements to prevent reductions.

- Settlement negotiation and enforcement: Your lawyer negotiates with insurers for accurate reimbursements, statutory interest, and penalties when warranted, and, if necessary, litigates to compel prompt payment under Florida’s PIP framework.

Long Term Effects of Fort Lauderdale PIP Claimss

You may face chronic pain management needs that persist long after the crash, requiring coordinated care and consistent documentation.

You could also encounter significant financial strain, as ongoing treatment, reduced work capacity, and coverage limits put pressure on your budget.

If your injuries are diagnosed late, you risk worsened outcomes and narrower claim options, which can complicate both medical recovery and compensation.

Chronic Pain Management

Negotiating chronic pain after a Fort Lauderdale auto accident demands a long-term strategy that integrates medical care, documentation, and legal planning under Florida’s PIP framework.

You prioritize consistent treatment, timely reporting, and clear records that link symptoms to crash-related injuries.

Collaborate with physicians to implement multimodal therapies, including targeted medications, physical therapy, interventional procedures, and behavioral pain coping skills.

Strengthen daily function through pacing strategies, gentle mobility work, and disciplined sleep hygiene, which stabilizes mood and reduces pain sensitivity.

You also coordinate subspecialist referrals, monitor side effects, and adjust plans as diagnostics clarify underlying sources.

Track pain levels, activity tolerance, and trigger patterns in a journal to support medical necessity.

With counsel, align treatment timelines, provider billing, and statutory deadlines to protect benefits while preserving future options.

Financial Strain Risks

Even when medical recovery progresses, long-term financial strain can intensify under Florida’s PIP system if cash flow, coverage limits, and deadlines aren’t managed with precision. You may face Medical debt when bills exceed policy limits, and providers pursue balances after partial payments.

Income loss compounds the burden, particularly if wage benefits are delayed or undercalculated, tightening monthly budgets and disrupting vital obligations. If you serve others, these pressures can ripple outward, affecting those who depend on you and your charitable commitments.

You can reduce risk by documenting every charge, disputing improper codes, and coordinating benefits with health insurance to prevent duplicate balances.

Track wage statements, verify eligibility windows, and meet examination deadlines to avoid denials. Consider structured payment plans, preserve credit by communicating early, and evaluate subrogation or liens before settling any claim.

Delayed Diagnosis Impacts

Financial strain often masks a deeper risk: delayed or missed diagnoses that surface after the initial PIP window. When you prioritize immediate bills, you may overlook subtle signs that later indicate more serious conditions.

Missed symptoms and diagnostic delays can convert treatable injuries into chronic impairments, undermining function, employability, and long-term health.

You serve others best by securing timely follow-up care, documenting every change, and insisting on expert evaluations when pain persists.

If insurers resist, you should preserve records, track referrals, and request independent assessments. These steps establish causation, strengthen your PIP claim, and protect access to rehabilitative therapy. You also reduce gaps in treatment that insurers exploit.

Vigilant monitoring, coordinated care, and decisive advocacy prevent escalation, support fair compensation, and safeguard your capacity to continue serving your community.

Proving Liability in Fort Lauderdale PIP Claims Car Accident Cases

While Florida’s no-fault system guarantees PIP benefits regardless of fault, establishing liability in a Fort Lauderdale car accident remains crucial for pursuing damages beyond PIP and preserving your legal leverage.

You should secure and preserve evidence immediately, including photographs, dashcam footage, black box data, and prompt witness statements.

Obtain the full crash report, then cross-check it against scene conditions, vehicle damage, and medical findings to identify inconsistencies.

Work proactively to neutralize comparative fault by documenting your safe driving conduct, compliance with traffic laws, and post-crash mitigation steps.

Seek expert testimony from accident reconstructionists, human factors consultants, and treating physicians to explain impact forces, reaction times, and causation.

Subpoena phone records, maintenance logs, and employer dispatch data when distraction, mechanical failure, or commercial policies may be involved.

Align medical timelines with collision mechanics to connect injuries to the crash.

Maintain chain-of-custody for all evidence.

Finally, present a coherent liability narrative that anticipates potential defenses and withstands scrutiny by the insurer.

Compensation for Fort Lauderdale PIP Claims Damages

Building on a strong liability record, you also need to understand what PIP actually pays and how to maximize every dollar available under Florida law. Personal Injury Protection typically covers a percentage of reasonable and necessary medical expenses and a portion of lost wages, up to the policy limit.

To secure full benefits, you should document every treatment, maintain organized billing, and confirm that providers accurately code services. Promptly notify your insurer, use in-network providers when possible, and submit complete proof-of-loss forms.

You can also strengthen your claim by coordinating benefits. Verify whether health insurance can step in after the PIP is exhausted, and avoid duplicate billing that may lead to denials.

Track mileage to appointments, attendant care, and replacement services when policy language allows, and challenge unreasonable reductions with clear medical support.

If the insurer demands an examination under oath or an independent medical examination, prepare carefully. Strategic advocacy, supported by meticulous records, helps convert your coverage into timely, full payment.

The Statute of Limitations for Fort Lauderdale PIP Claims Cases

Although PIP is a no-fault benefit, strict deadlines govern every stage of a Fort Lauderdale claim, and missing one can forfeit recovery.

Florida’s statute of limitations for PIP-related actions is short, and the clock can start sooner than you expect. You must seek initial medical treatment within 14 days of the crash, or benefits may be denied.

Billing and proof-of-loss timeframes also apply, and insurers strictly adhere to them. Track every date, from the accident to each bill submission, because late filings jeopardize reimbursement.

Statutes can change, so monitor policy updates and recent legislative amendments that may compress or extend deadlines. Limited filing exceptions may exist, such as tolling for incapacity or fraud investigation, but they’re narrow and fact-specific.

Preserve evidence early, maintain orderly records, and confirm receipt of all submissions. If a deadline is unclear, request written clarification from the insurer, and document the communication. Acting quickly protects benefits and serves those who do it.

Why You Need an Experienced Fort Lauderdale PIP Claims Injury Lawyer

Because PIP claims move quickly and insurers scrutinize every detail, you need an experienced Fort Lauderdale PIP injury lawyer to protect coverage and maximize recovery.

You can just rely on a seasoned Fort Lauderdale PIP lawyer to protect coverage and maximize your recovery.

You’re focused on healing and serving your family and community; your lawyer safeguards deadlines, evidence, and benefits so that treatment can continue without interruption.

Skilled counsel identifies permissible medical expenses, challenges coding errors, and confronts underpayments, ensuring your providers are compensated promptly.

A seasoned attorney also recognizes red flags for insurance fraud and shields you from unfair accusations. If your injuries intersect with potential medical malpractice, your lawyer coordinates records, expert reviews, and parallel claims without jeopardizing PIP benefits.

They manage recorded statements, negotiate with adjusters, and prepare litigation when necessary, preserving leverage.

Precision matters. Your attorney verifies the valuation of lost wages, mileage, and diagnostic testing, and compels compliance with Florida’s PIP statute. With a vigilant advocate, you reduce administrative burdens, resolve disputes decisively, and secure the resources required to move forward responsibly.

How to Choose the Right Fort Lauderdale PIP Claims Injury Lawyer for Your Case

Before you sign a retainer, define your priorities and vet each candidate against objective criteria. Begin by confirming focused PIP experience, recent case outcomes, and familiarity with Fort Lauderdale courts and insurers. Review disciplinary history, professional memberships, and published resources that demonstrate current knowledge.

During client interviews, assess responsiveness, clarity, and respect for your time, noting whether the lawyer explains benefits coordination, medical billing disputes, and policy limits in plain terms.

Request a written outline of fee structures, including contingency percentages, costs advanced, and what happens if the claim resolves early or proceeds to litigation. Ask who’ll handle day‑to‑day work, how often you’ll receive updates, and what metrics define success beyond settlement size.

Examine workload and support staff capacity to guarantee prompt filings and medical record retrieval.

Finally, demand a strategy preview tailored to your facts, and select counsel whose plan aligns with your service‑oriented goals and risk tolerance.

About the Law Offices of Anidjar and Levine

Driven by a client-first ethos, the Law Offices of Anidjar and Levine offers focused representation for Fort Lauderdale residents managing PIP claims and related injury matters. You receive attentive counsel, prompt communication, and strategic advocacy designed to safeguard your recovery and peace of mind.

The firm’s attorneys coordinate medical care, preserve evidence, and negotiate assertively with insurers, ensuring each step advances your interests.

You’ll work with a team that values measurable results and transparent guidance.

Client testimonials consistently highlight responsiveness, professionalism, and a disciplined approach to intricate PIP disputes.

The firm maintains accessible office locations, allowing you to meet counsel conveniently, review documents securely, and receive timely updates regarding deadlines and benefits.

From initial consultation through resolution, you’ll have clear expectations, practical options, and decisive representation.

The lawyers prepare every claim with litigation-ready rigor, which strengthens your negotiating position and promotes efficient outcomes.

Your case receives focused attention, disciplined case management, and unwavering advocacy grounded in experience and accountability.

Frequently Asked Questions

How Does PIP Coordinate With My Private Health Insurance in Florida?

PIP pays first as primary coverage, handling up to 80% of reasonable medical expenses and 60% of lost wages, subject to policy limits.

You submit bills to PIP promptly, then your private health insurance may cover the remaining costs after deductibles or copays. Your health plan may require PIP exhaustion before paying.

Insurers may assert subrogation rights to recover amounts from liable parties.

Maintain meticulous records, coordinate with providers, and adhere to notice and claim deadlines.

Can I Choose My Own Doctor for Pip-Covered Treatment?

Yes, you can choose your own doctor for PIP-covered treatment, but your physician must accept PIP and comply with billing rules.

You may choose from various physician types, such as primary care, specialists, or chiropractors, prioritizing timely care and documentation.

Insurers can’t force one provider, though they may request independent exams.

Exercise careful physician selection, verify PIP acceptance before treatment, and keep detailed records to protect benefits, meet deadlines, and ensure coordinated, patient-centered care.

Will Using PIP Increase My Auto Insurance Premiums?

Yes, using PIP can increase your auto insurance premiums, depending on your insurer’s underwriting and your claims frequency.

Insurers evaluate policy impacts by reviewing prior losses, accident fault, and payout amounts, then adjust rates accordingly.

If you file multiple PIP claims, you’re more likely to face a surcharge.

You can mitigate increases by promptly reporting incidents, following medical protocols, and documenting treatment, demonstrating responsibility that supports fair rating and serves both your interests and community safety.

How Are PIP Benefits Affected if I Was Partially at Fault?

Your PIP benefits typically pay regardless of fault, so partial responsibility doesn’t eliminate coverage. However, comparative negligence and fault apportionment can affect related claims beyond PIP, such as pain and suffering under bodily injury claims.

PIP may still limit wage and medical reimbursements by statutory percentages, not fault. You should document treatment promptly, cooperate with your insurer, and coordinate benefits ethically to minimize disputes, preserve credibility, and make certain injured parties receive timely, fair support.

What Documentation Do Insurers Require to Process PIP Reimbursements?

Insurers typically require a completed PIP application, accident report, and proof of identity and coverage.

You’ll submit medical records detailing diagnoses, treatment plans, and provider notes, plus billing statements itemizing charges, CPT codes, and dates of service.

Include wage verification for lost income, mileage logs for medical travel, and proof of payment if you’ve advanced costs.

Make sure documents are legible, consistent, and timely, so adjusters can verify necessity, causation, and policy limits without delay.

——————

You are entitled to timely PIP benefits and strategic advocacy. Our team analyzes your policy, preserves evidence, challenges unfair denials, and negotiates for full compensation, including medical costs and lost income.

Don’t delay, as strict deadlines govern PIP claims and litigation.

We’ll guide you through every step, communicate clearly, and protect your rights at each stage. Contact the Law Offices of Anidjar & Levine for a no-obligation consultation, and put experienced Fort Lauderdale counsel to work for your recovery.

Learn more here: Fort Lauderdale Car Accident Lawyer